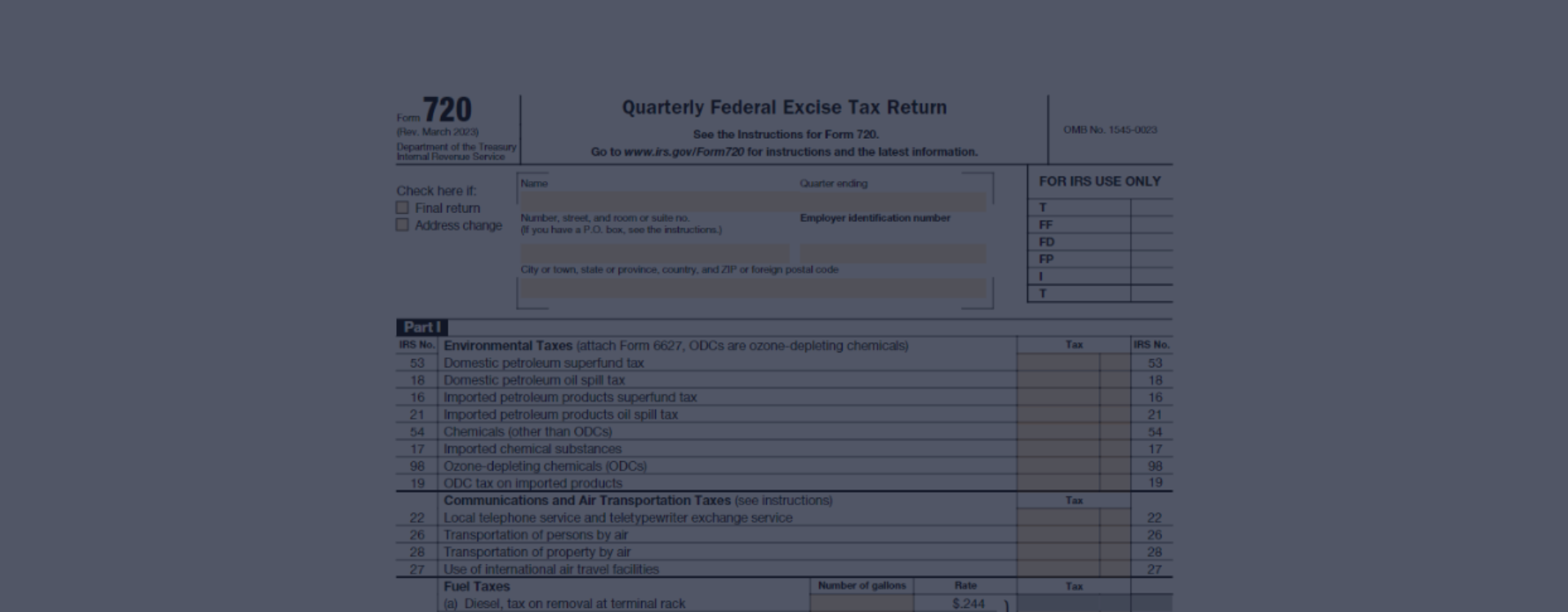

IRS Form 720: The Ins and Outs of Excise Tax Reporting

IRS Form 720, colloquially recognized as the Quarterly Federal Excise Tax Return, encompasses an intricate yet imperative document that necessitates meticulous completion by business entities operating within the United States who engage in the sale or manufacturing of certain goods and services to accurately report and submit the corresponding financial obligations to the government for the year 2023. Though seemingly daunting in its complexity, the IRS Form 720 for excise tax plays a quintessential role in ensuring the proper functioning of the American economy by establishing accountability and transparency in the realm of taxation.

Check Out Our Form 720 Instructions & Examples

In light of the abovementioned intricacies, the value of the website 720-excise-tax.com should not be underestimated, as it provides an extensive repository of materials, including comprehensive instructions, elucidating examples, and invaluable resources designed to aid individuals and organizations alike in their endeavor to fill out IRS Form 720 correctly and efficiently. By offering the opportunity to file Form 720 online, the website not only streamlines the process but also contributes to the enhancement of the user experience, ultimately promoting a deeper understanding of the excise tax system and its implications for businesses. Thus, it is unequivocally clear that the resources provided by 720-excise-tax.com serve as an indispensable tool in the realm of tax compliance and financial responsibility.

Form 720: Quarterly Excise Tax Return & U.S. Business

The IRS Form 720 is a mandatory fiscal document that necessitates submission by manifold individuals and businesses in diverse situations. In accordance with the IRS Form 720 instructions for 2023, entities filing the document typically consist of those responsible for collecting federal excise taxes on an array of products and services.

Consider, for instance, a hypothetical entrepreneur named Alexander who operates an enterprising conglomerate of service stations that dispense gasoline to a vast multitude of vehicular clientele. Being profoundly cognizant of his responsibilities, Alexander conscientiously looks for Form 720 for 2023 in PDF to fill out and ascertain his precise tax implications. He must file Form 720 in order to remit the appropriate excise taxes on the voluminous quantities of gasoline his enterprise dispenses.

Envision a second fictitious individual named Isabella, who, as the proprietor of a sizable tanning salon, furnishes many customers with the alluring prospect of achieving a sun-kissed countenance through the utilization of tanning services. Consequently, in her unrelenting pursuit of compliance with the labyrinthine tax code, Isabella fills out the printable IRS Form 720, which unmistakably delineates her obligation to file the aforementioned copy to account for the indoor tanning taxes her establishment accrues.

The 720 Tax Form Assignments

-

![PCORI Fee]() PCORI FeeForm 720 filed by employers, insurance providers, and plan sponsors to report and pay the PCORI fee to the IRS. The fee collected through Form 720 provides funding for PCORI's research activities.

PCORI FeeForm 720 filed by employers, insurance providers, and plan sponsors to report and pay the PCORI fee to the IRS. The fee collected through Form 720 provides funding for PCORI's research activities. -

![Remittance Facilitation]() Remittance FacilitationEnsuring expeditious, unswerving transference of requisite excise payments, this document assuages the process of effectively remitting tax dues to the pertinent governmental authorities.

Remittance FacilitationEnsuring expeditious, unswerving transference of requisite excise payments, this document assuages the process of effectively remitting tax dues to the pertinent governmental authorities. -

![Compliance Assurance]() Compliance AssuranceIt bolsters adherence to stringent, obligatory taxation regulations, thereby fostering steadfast, unwavering conformity to the prevailing legal mandates governing excise taxes in the United States.

Compliance AssuranceIt bolsters adherence to stringent, obligatory taxation regulations, thereby fostering steadfast, unwavering conformity to the prevailing legal mandates governing excise taxes in the United States.

Steps to Fill Out Form 720 in 2023

Embarking on the journey of correctly completing the 720 excise tax form for 2023 can be a perplexing endeavor. However, it is essential to gain a comprehensive understanding of the imperative information required for each box. This will ensure a thorough, accurate, and successful submission of the document.

- To commence, one must obtain the fillable 720 excise tax template, which can be easily accessed online, or print out the paper copy. Upon acquiring the form, it is crucial to meticulously input the necessary data, such as the employer identification number, business name, and address. Additionally, one must carefully delineate the fiscal period and the applicable tax rates.

- To further elucidate, the federal form 720 instructions provide a detailed explanation of the various tax categories that must be entered in specific boxes. This information is instrumental in ascertaining that the correct amounts are reported, thus preventing potential errors.

- In order to circumvent any inadvertent blunders, it is highly recommended to thoroughly review the form once completed. Moreover, seeking professional guidance is an advantageous decision for those who remain uncertain about any aspect of the process.

File Form 720 With the IRS on Time

The deadline for submitting Form 720, Quarterly Federal Excise Tax Return, is on the last day of the month succeeding each fiscal quarter. Consequently, the repercussions for neglecting this responsibility or providing erroneous data are rather severe. Noncompliance may result in significant pecuniary penalties, which are directly proportional to the delay in filing Form 720. Additionally, deliberate falsification of information can lead to more grievous consequences, including legal ramifications and potential criminal charges.

The Printable IRS Form 720 Benefits

There are a few different ways to file Form 720 with the IRS, one of which is completing a printable version. This option has several advantages, such as allowing taxpayers to physically fill out and review the copy before submitting it. Additionally, having a hard copy of the form creates a tangible record that can be easily referred to and stored for future reference. Furthermore, those who are not confident in their digital skills may find the printable version more user-friendly.

IRS Form 720 Fillable PDF

Another popular method is to file a fillable Form 720 to the IRS. One key benefit of this approach is its convenience: taxpayers can complete and submit the PDF from virtually anywhere, as long as they have an internet connection. Moreover, online filing often results in faster processing times, which can expedite potential refunds or the resolution of any issues. Additionally, using an online sample can reduce the risk of errors, as many platforms feature built-in validation tools that help ensure the information entered is accurate and complete.

Fill OnlineFAQs: 720 Federal Excise Tax Form for 2023

- What is IRS Form 720, Quarterly Excise Tax Return, and who needs to file it?It’s used by businesses to report and pay federal excise taxes on a quarterly basis. Companies that deal with the sale or manufacture of specific goods, services, or activities subject to excise taxes must file this form. Examples include fuel taxes, environmental taxes, and communication taxes.

- Can you provide for Form 720 excise tax example of usage?A typical example is the federal gasoline tax. Gasoline distributors report and pay the excise tax to the IRS. They would complete Form 720 to specify the amount of gasoline sold during the quarter and calculate the total tax due based on the current tax rate.

- Where can I find Form 720 excise tax instructions?Detailed instructions for completing and filing Form 720 can be found on our website. The instructions include information on which businesses must file, how to fill out the form, and how to calculate the excise tax due. Additionally, they offer guidance on where to mail the completed sample and any tax payments required.

- Explain who needs a sample of Form 720 for PCORI?The Patient-Centered Outcomes Research Institute (PCORI) fee is a specific excise tax reported on Form 720. This fee is imposed on health insurance issuers and sponsors of self-insured health plans to fund comparative effectiveness research. The sample requires reporting the total number of covered lives per quarter and the applicable levy rate to calculate the total PCORI fee due.

- Is there an IRS Form 720 fillable version available online?Yes, you can access the fillable version on our website. You can download the form, fill it out electronically, and print it for submission. This can help ensure accuracy and streamline completing and filing your quarterly excise tax return.

Form 720 & PCORI Instructions

IRS Form 720 Fillable IRS Form 720, also known as the Quarterly Federal Excise Tax Return, is a crucial document for businesses that are required to pay excise taxes on certain goods and services. These taxes could include environmental, communication, air transportation, and fuel taxes, among others. The form is submitt...

IRS Form 720 Fillable IRS Form 720, also known as the Quarterly Federal Excise Tax Return, is a crucial document for businesses that are required to pay excise taxes on certain goods and services. These taxes could include environmental, communication, air transportation, and fuel taxes, among others. The form is submitt... - 8 May, 2023

- Printable IRS 720 Form The printable IRS Form 720 is an essential document for businesses that deal with excise taxes. The document layout consists of separate sections, each dedicated to a specific type of excise tax. Understanding the format of the printable 720 form for 2023 is crucial to ensure accurate comp...

- 5 May, 2023

- Form 720 Instructions for 2023 IRS Form 720 is a federal excise tax return document that businesses and individuals must file quarterly to report taxes on specific goods, services, and activities. These taxes are imposed on the manufacturer, retailer, or service provider rather than the consumer. The purpose of Form 720 is to col...

- 4 May, 2023

IRS Form 720 in PDF for 2023

Get FormPlease Note

This website (720-excise-tax.com) is not an official representative. All the copyrighted materials belong to their respective owners. All the content on this website is used for educational and informative purposes only.